Customer Value

What is a Customer Value?

Customer value is a metric measuring the worth a customer brings to a business over their entire relationship. It encompasses the revenue generated, repeat purchases, and referrals. Understanding customer value is vital as it identifies high-value customers, guides resource allocation, and informs marketing strategies. Analyzing this metric enables you to segment customers effectively, tailor personalized experiences, and prioritize efforts to retain and nurture valuable relationships. By optimizing customer value, you can increase customer lifetime value, foster loyalty, and drive sustainable growth. Strategies such as improving customer satisfaction, offering personalized incentives, and enhancing the overall customer experience can all contribute to maximizing customer value and ultimately boosting the bottom line.

How to calculate Customer Value?

Calculate customer value by multiplying the average purchase value by the average purchase frequency rate and then multiplying that by the average customer lifespan.

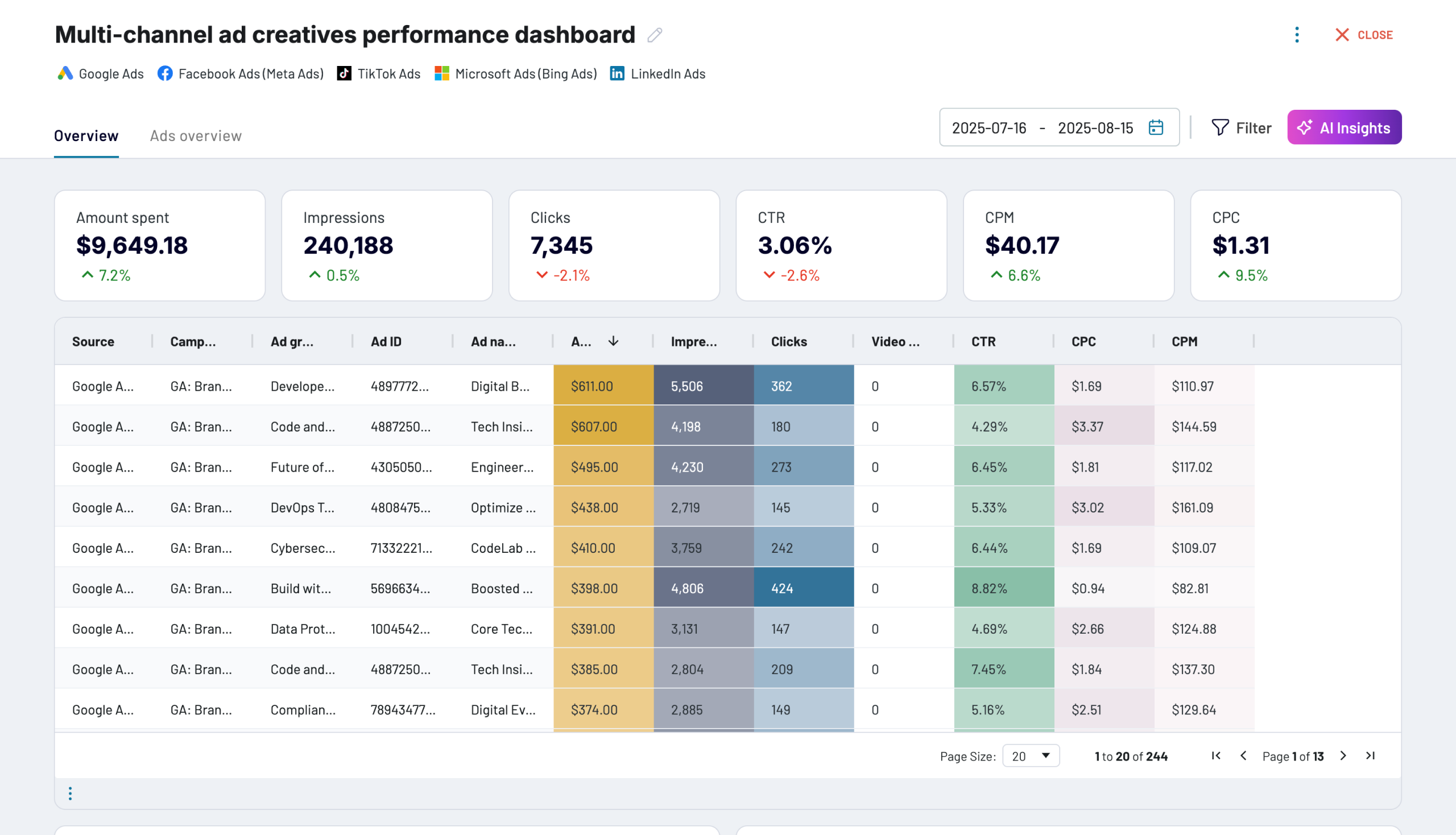

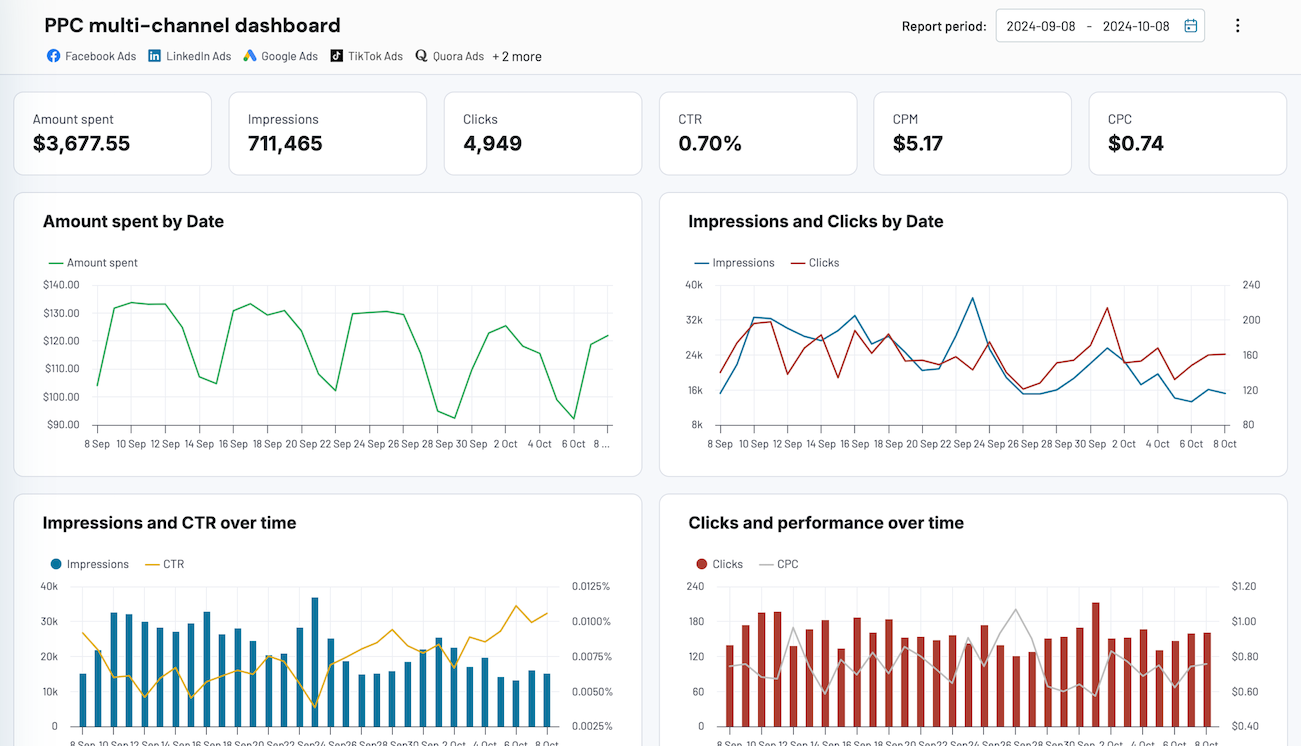

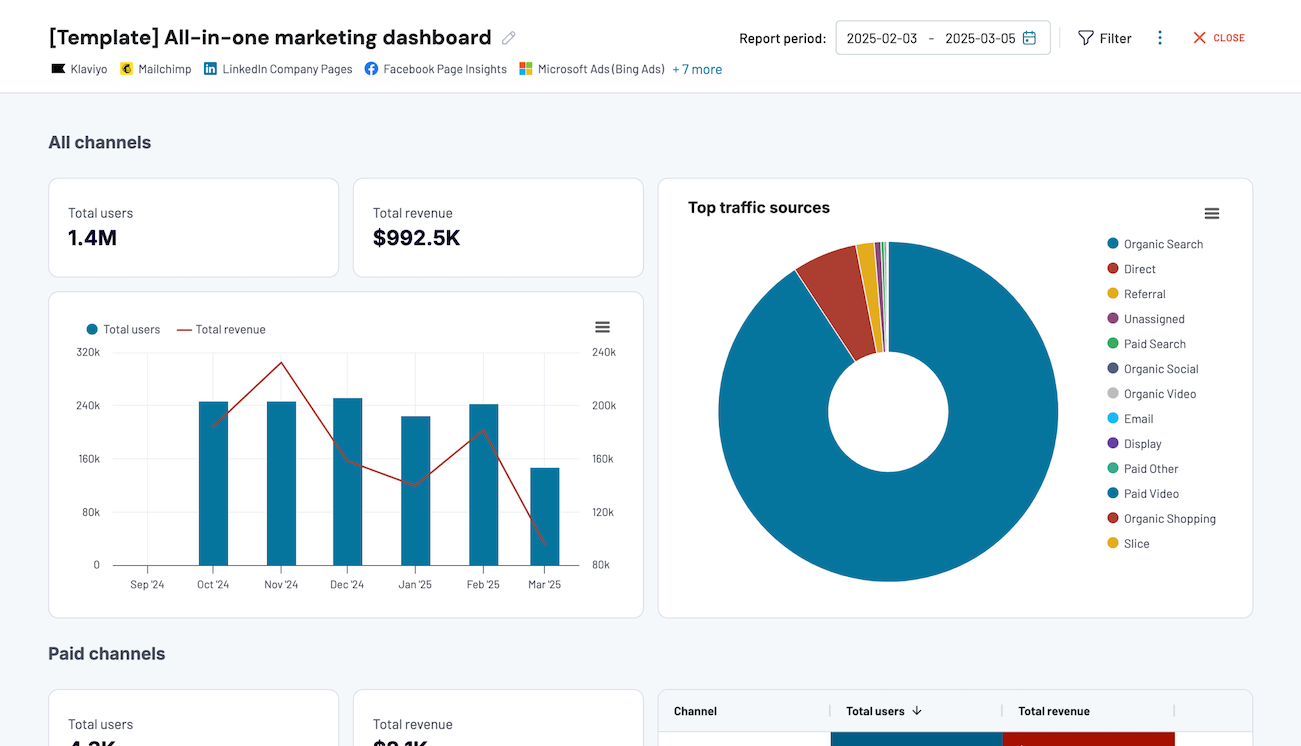

Our key templates to track Customer Value

+3

+3

+6

+6

about your case. It doesn't cost you a penny 😉