Accounting dashboard examples for every need

about your case. It doesn't cost you a penny 😉

What is an accounting dashboard?

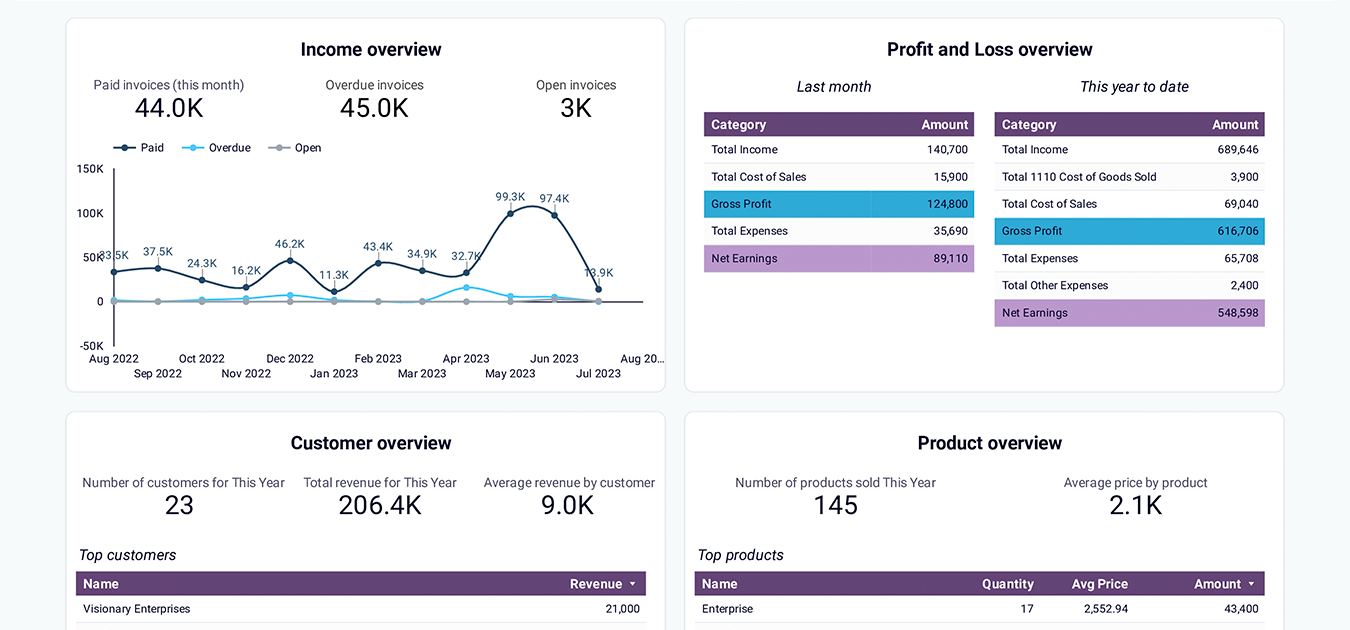

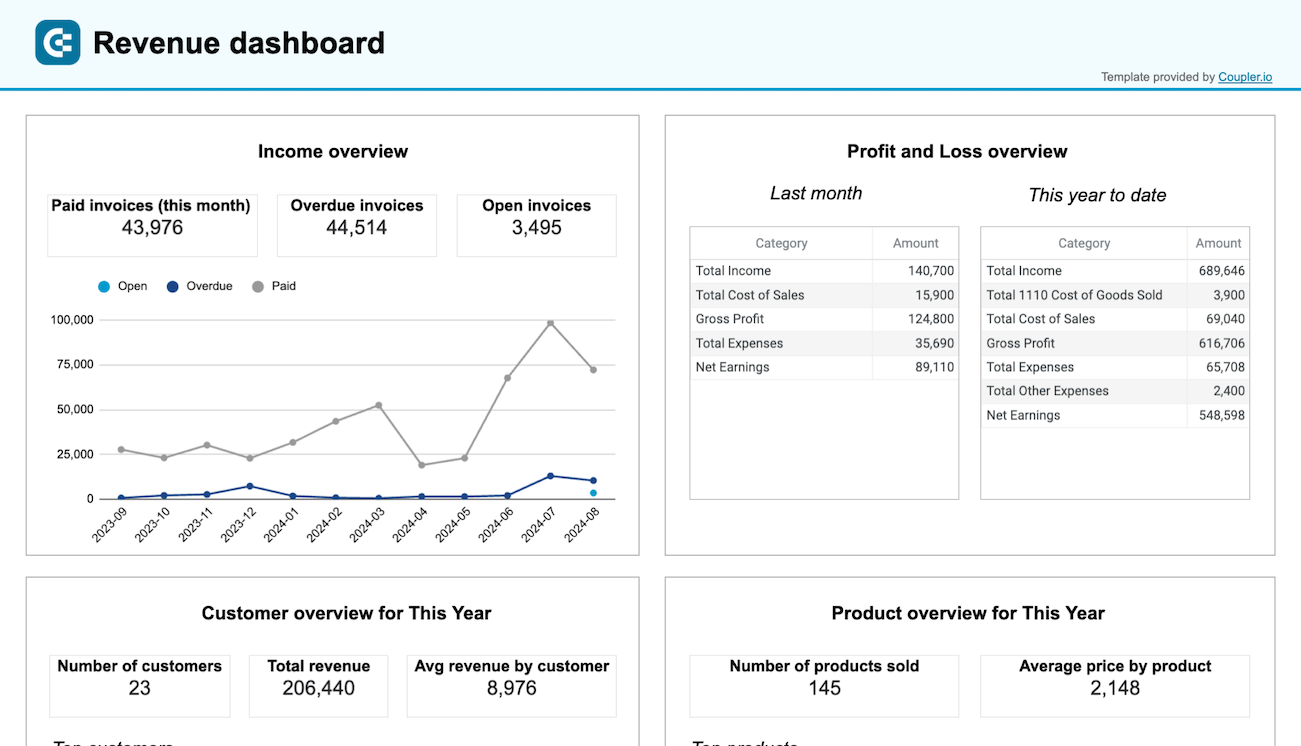

An accounting dashboard is a visual representation of your company's financial health that consolidates key metrics from various accounting reports into a single view. It transforms raw financial data from sources like QuickBooks and Xero into clear, insights about your business performance.

By automating data collection and visualization, an accounting dashboard template eliminates manual reporting work. It also provides real-time visibility into critical financial reports such as profit and loss, cash flow, accounts receivable, and accounts payable. This enables finance professionals and business owners to make informed decisions based on up-to-date data rather than outdated reports.

Choose your Accounting dashboard template to kick off

What should be included on accounting dashboards?

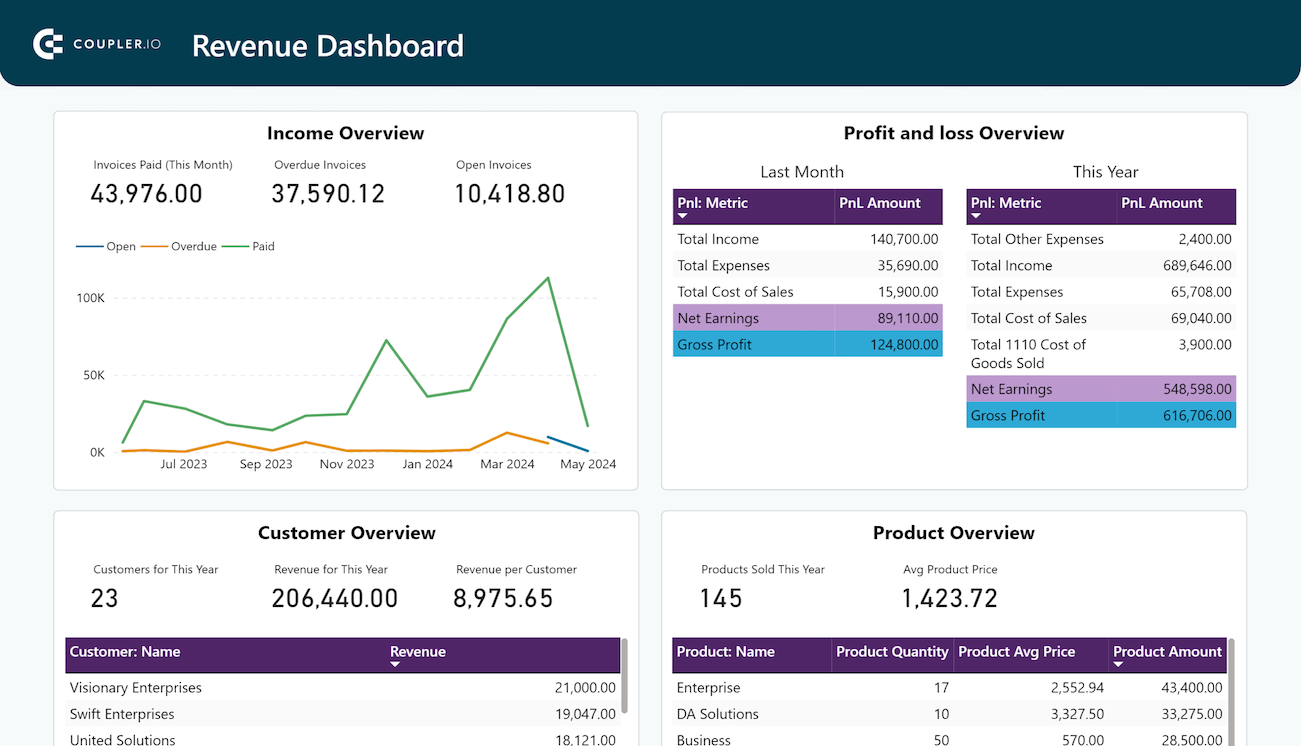

A well-designed accounting dashboard should start with core financial metrics that provide a snapshot of your business health. This includes profit and loss statements showing revenue trends, expense breakdowns, and net income calculations. The balance sheet section should display current assets, liabilities, and equity positions. They help you understand your company's financial standing at a glance. These metrics should be presented both as current values and historical trends. This way, you can track performance over time and identify patterns in your financial data.

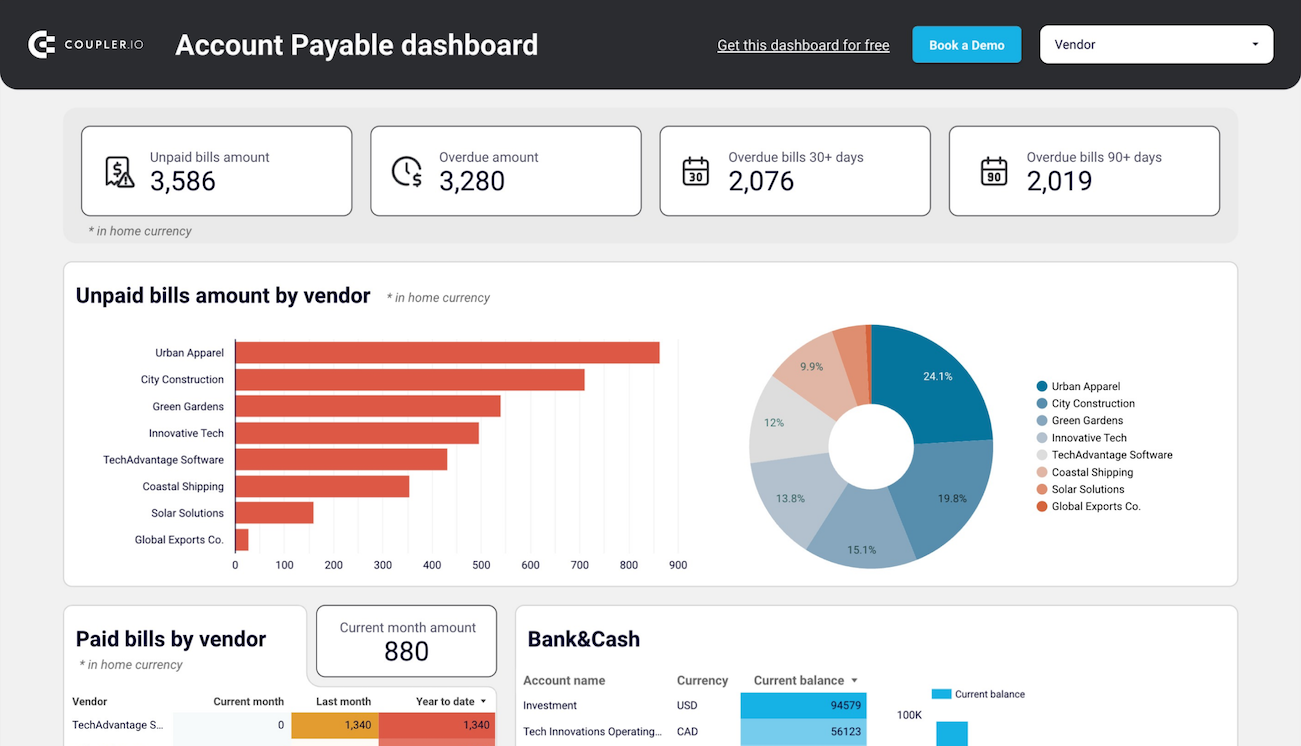

Effective cash management is crucial for business operations, so your accounting dashboard template should include a detailed cash flow analysis. This encompasses bank and cash account balances across different currencies, cash inflows and outflows tracking, and working capital monitoring. The dashboard should highlight key metrics like operating cash flow, collection periods, and liquidity ratios. This is helpful to maintain healthy cash positions and anticipate potential cash flow gaps.

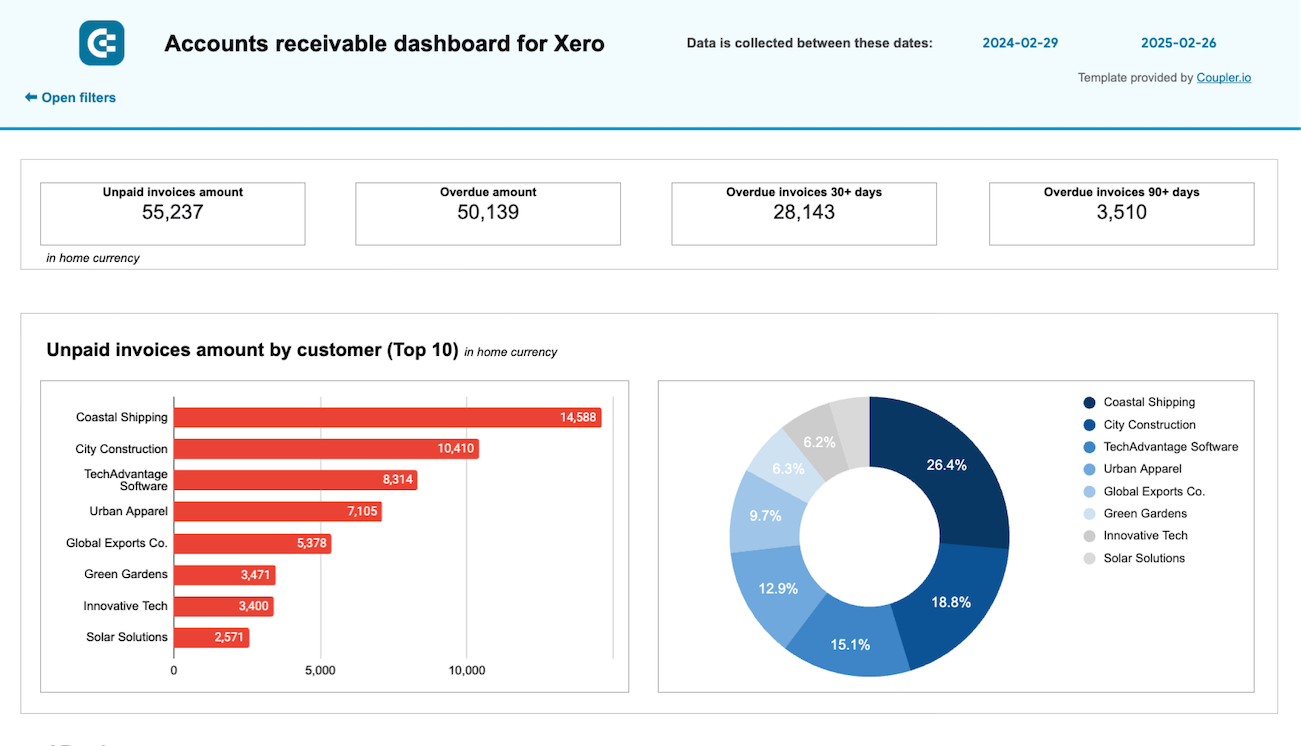

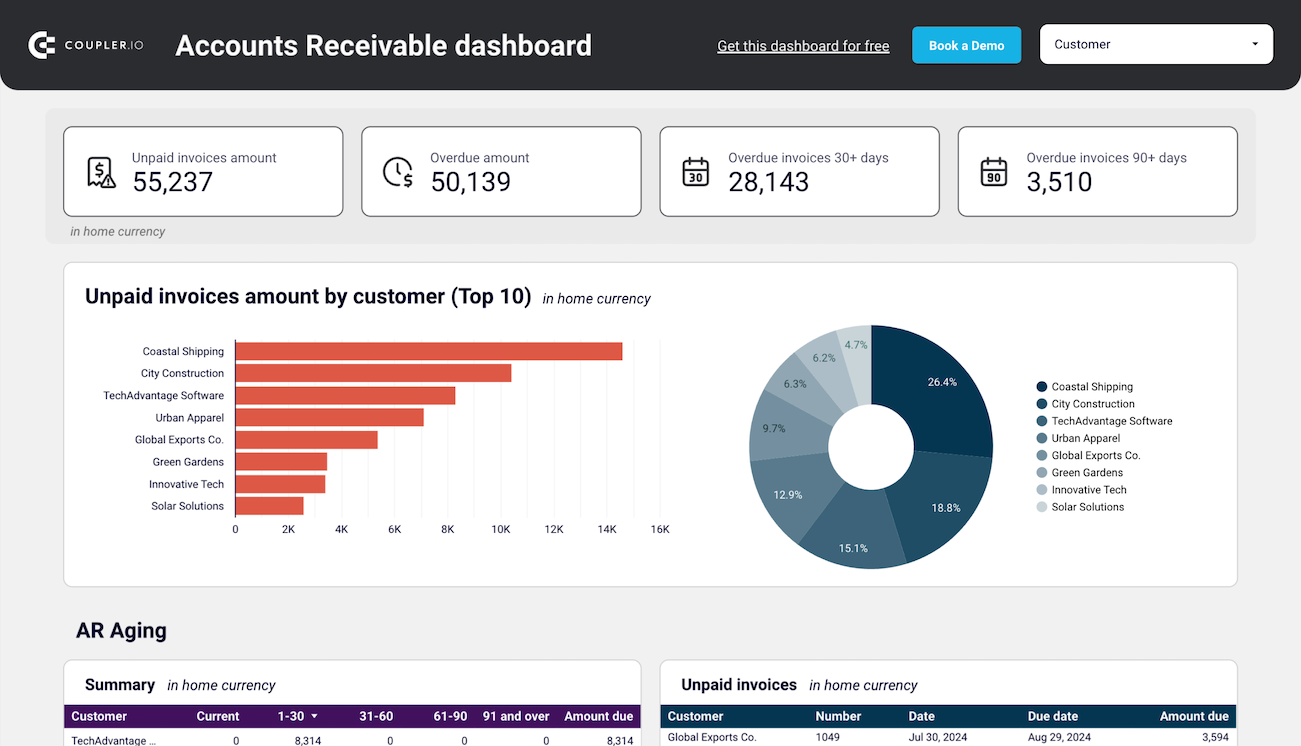

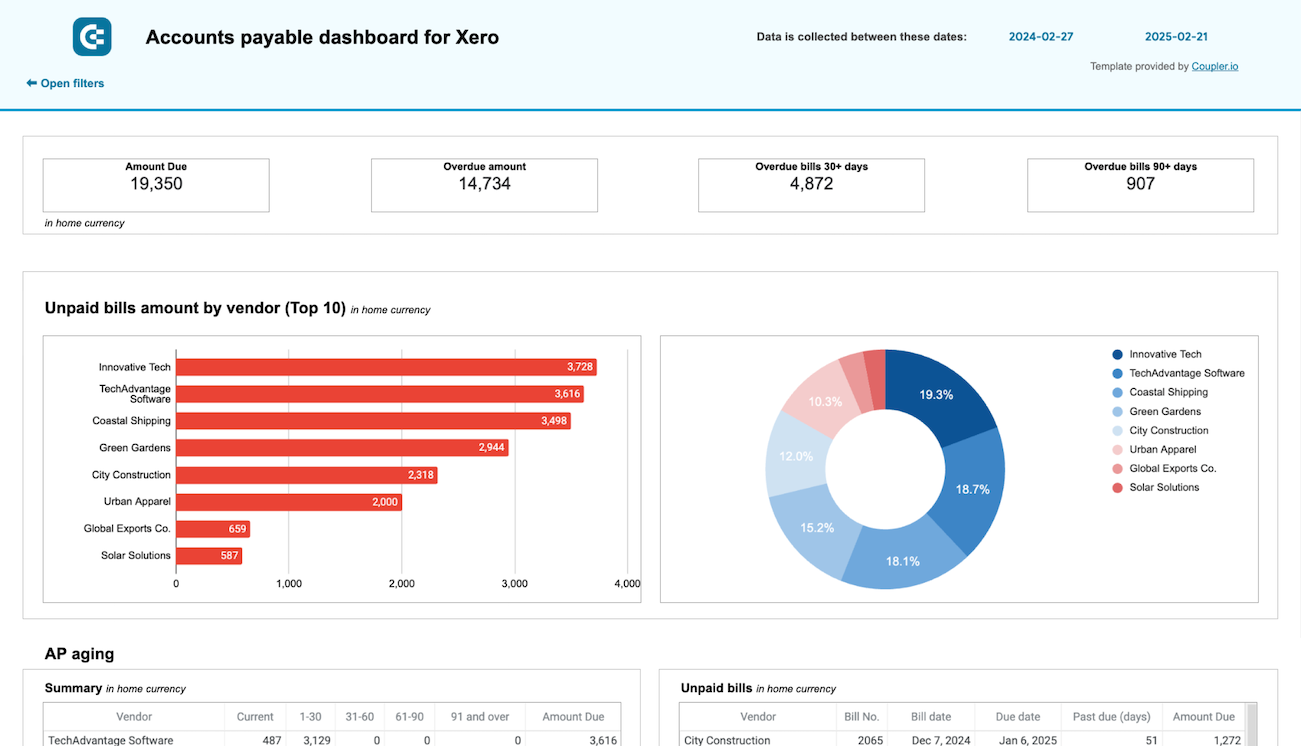

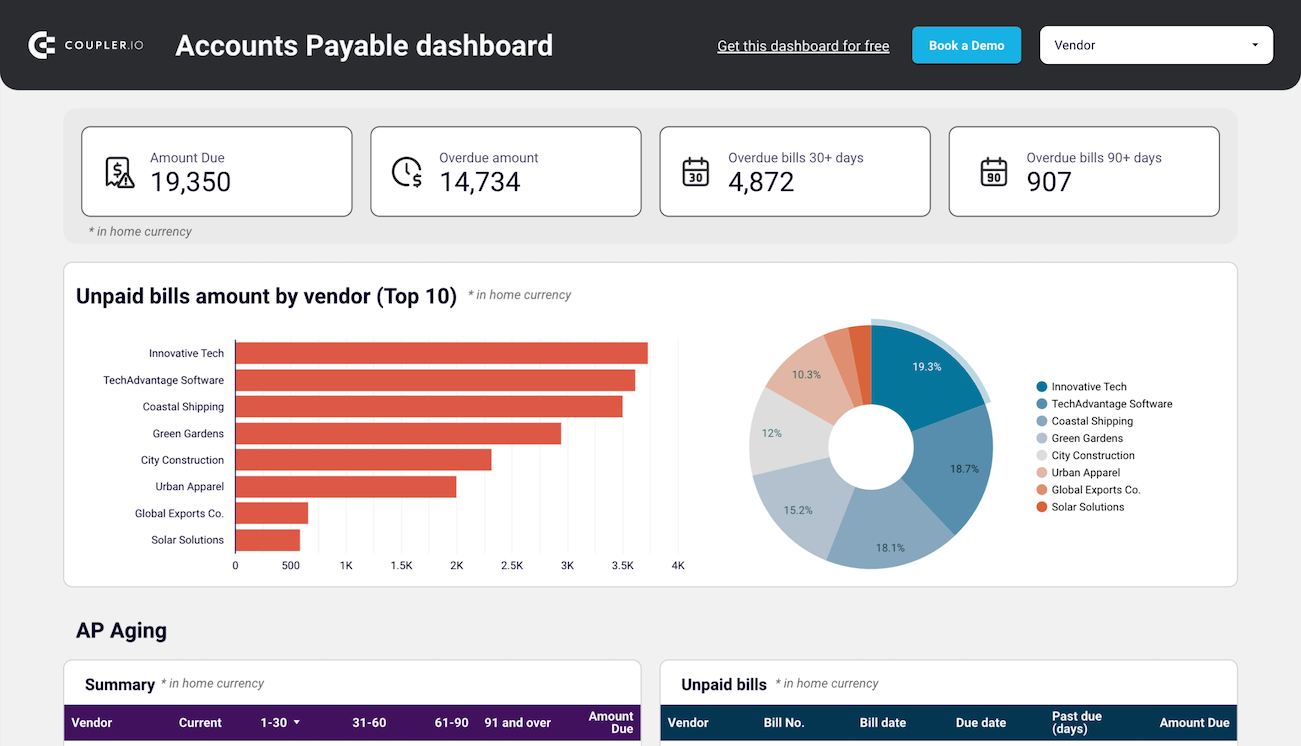

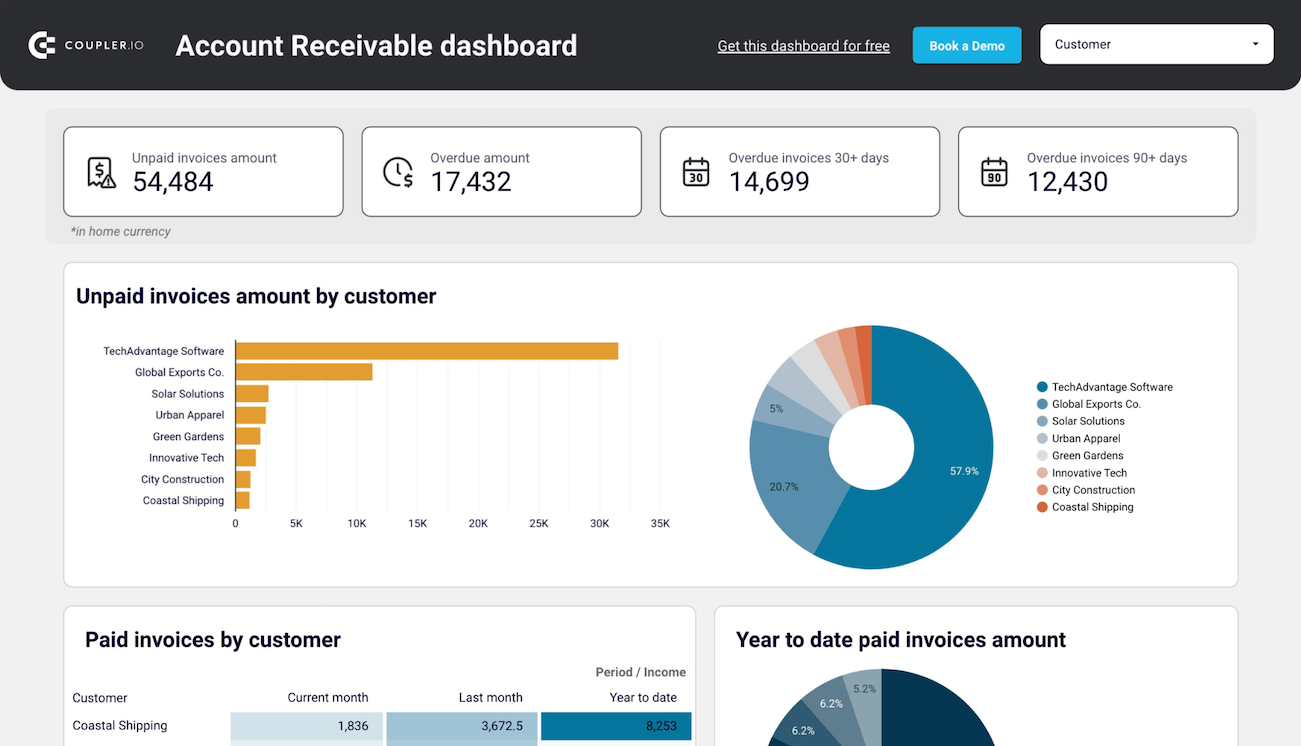

Accounting dashboards should also enable you to monitor accounts receivable and accounts payable. For receivables, this includes aging reports showing overdue amounts by customer and time period, upcoming payment schedules, and trends in collection performance. For the account payables, you need to track vendor obligations, payment deadlines, and spending patterns. These insights help optimize working capital management by balancing incoming payments with vendor obligations.

Why do you need an accounting dashboard?

Modern businesses require real-time visibility into their financial performance to make informed decisions. By implementing an accounting dashboard template, you gain instant access to key financial metrics without the need for manual data compilation. The dashboard automatically pulls data from your accounting software, whether it's QuickBooks or Xero. The data is transformed into clear visualizations that highlight trends, patterns, and potential issues in your financial data.

This automated approach not only saves time but also reduces the risk of reporting errors. It also ensures your financial analysis is always based on fresh data. With Coupler.io's automated data refresh capabilities, your accounting dashboards stay up-to-date, providing reliable insights for financial planning and decision-making.

How to choose a perfect accounting dashboard template for your needs?

First, identify whether your financial data comes from QuickBooks, Xero, or other accounting systems. Ensure the dashboard template supports your data source and can handle your data volume effectively. Coupler.io's templates are specifically designed to work seamlessly with major accounting platforms and are available for free plan users.

Consider which financial metrics are most critical for your business operations. Do you need a financial overview dashboard that covers all aspects of your business, or would you benefit more from focused dashboards for specific areas like accounts receivable or cash flow management? Your choice should align with your reporting frequency and the level of detail required for decision-making.

Look for dashboard templates that present financial data in clear, actionable formats. The visualizations should make it easy to spot trends, identify issues, and track progress toward financial goals. Consider whether you need to customize the dashboard for specific metrics or reporting formats, and ensure the template can be adapted to your business's unique requirements.

Request custom dashboard

From building custom dashboards to setting up data analytics from scratch, we're here to help you succeed. Contact us to discuss your case and possible solutions

Contact us